07 Apr BUSINESS BANKING IN THE BUSH – THE EVE OF EVOLUTION

The regulations of the New South Wales Savings Bank (1819) encouraged settlors to abstain from the temptations of gambling, and alcohol lest they remain poor, vicious, and unmarried.

~ Reserve Bank of Australia

A Brief History of Banking

Banks have always evolved, ever since the first bank being the Bank of New South Wales was established in Sydney in 1817 with Edward Smith Hall as its cashier and secretary. Since then the Australian banking system has been tightly regulated all the way up to 1980’s which created insurmountable barriers for foreign banks to enter Australia. This created the foundation of the four pillars (WBC, CBA, ANZ and NAB) to capture the market under a legacy of protectionism and created the framework we witness today.

Strength is its Hindrance

From a peripheral view, this legacy framework is both a strength and hindrance. Its strength lies pertained within the loyalty of extended market dominance and familiarity, its branding and client positioning, years of reinvestment in product creation and distribution. The hindrance is its irrevocable social contract with their clientele in maintaining a physical presence across Australia’s geographic postcodes coordinated by layers of management that are subject to constant ruptures and fractures.

Technology and the Variable Costing Formula

Let us focus on the millennia. Technology has closed the gap of real time information and accessibility to information. This notion has now drifted into the human workforce spectrum with accessibility to global human resource talent that can be tendered for on job by job basis. Contracting talent for the job at hand. The creation of variable costing business model is now within reach.

Inflexible Overhead Structure

Banking, like most corporates, have been built upon a physical platform of bricks and mortar outstations to channel distribution with a high percentage fixed human resource inputs. Given the undercurrents of people constantly seeking career advancements, reassignments, maternity leave, holidays, sick days, resignations, conferences and training in the midst of economic thrusts of activity then moments of commercial reprieve; work flows and processes are constantly either under or over resourced. Constant changes of management, recruitment & retrenchment are all attempts to balance the equation to these internal ruptures and economic swings. All at a time whilst trying to promote quality of service and value proposition to their clients.

Service Quality or Price Driven

The clientele are caught in the backwash and the brunt of this activity. If the clientele loses faith in the corporate’s desired valued expression, then the corporate’s values are whittled down to a mere commodity and it then becomes a victim to a function of price.

Recognition of Core Strength

What are banks really good at? They are fantastic at origination, innovation, balance sheet risk management and product development. Critical processes in driving profitability. What if they could remove the massive distribution overhead that is replicated by the four pillars into one platform, and outsource the service proposition model to one of private enterprise and variable costing? Private Enterprise creates the commitment and can be the reliable constant in the client’s business. Origination is then provided by the banks with the bank providing the best product, policy, pricing and support winning the client’s business.

The Paradigm Shift

This is not a new concept. Over 50% of all mortgages are now sourced by third party providers and this number continues to grow. For agribusiness in regional and rural Australia the market is immature given the intellectual property and framework that is required to be applied.

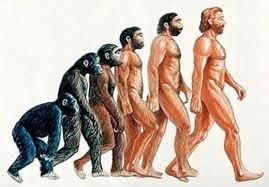

The Evolution of Banking: Now Accessible

Robinson Sewell Partners has now created a (national) platform to perform this function. It is a gateway for bankers to apply their acclimated skillset in private enterprise, to create a sustainable wealth creation business as a legacy to their family and most importantly to generate a tangible and positive impact for their clients.

If curious, check out our careers page to see what it entails…

https://robinsonsewell.com.au/careers.aspx

We are on the Eve of Evolution.

Sorry, the comment form is closed at this time.